Multi-level Bracket Order |

Multi-level Bracket Orders submits multiple stops and targets for an entry order as defined in the template. User can further assign a stop strategy and trail the stop.

Please follow the below steps to define a new Cover Order.

- Click on the Add button of the Order Template

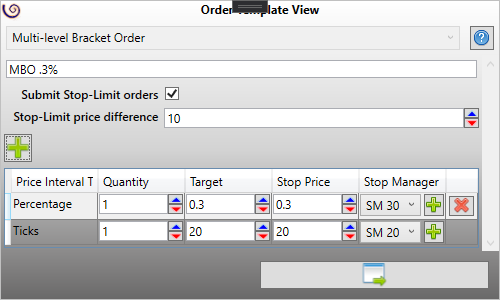

- In the Order Template View select 'Multi-level Bracket Order' from the drop down items

- Append a suitable name in the Name textBox

- If you wish to submit a Stop-Limit order then check the option 'Submit Stop-Limit orders'

- In case you have selected to place a Stop-Limit order then please append a suitable stop-limit difference price (in ticks)

- Click on the Add button to define the bracket levels

- In the newly added bracket level select the Calculation Mode

- Append the quantity for the level

- Set the Target and Stop price. Note the stop and target price will be calculated as per the selected Calculation Mode.

- If you want to trail the stop(s) you can assign a stop strategy. Please refer to the below section "How to trail the stop" for more details.

- Repeat the steps from 4-8 for each additional bracket levels.

- Click on the Ok button

|  |

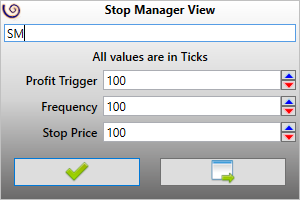

The Multi Level Bracket Order template allows user to define a stop strategy so that user can trail the stop. The stop strategies are defined in a template and just like the order templates user can reuse it and can simply assign a template as needed. A stop strategy template has three parameters, namely

- Profit trigger - This value defines the initial trigger price at which the stop order will be adjusted.

- Frequency - This value defines how frequently the stop is subsequently trailed. If the value is set to 0 (zero) then the stop is no longer trailed.

- Stop Price - The modified stop price as calculated from the profit trigger (and frequency for subsequent trail) price

Note - All values of the stop strategy template are in Ticks.

Please follow the below steps to create a stop strategy template:

- Click on the Add button as located in the column 'Stop Manager'

- Append a suitable name in the Name textBox

- Append appropriate values of the properties - Profit trigger, Frequency and Stop price

- Click Ok

Now you can simply assign the newly created stop strategy template from the drop-down menu from the column 'Stop Manager'

Let us illustrate with some examples:

Examples 1

The stop strategy template is defined as below:

- Profit trigger - 20

- Frequency - 10

- Stop price - 20

Now assuming the tick size of the instrument as 0.05, and your average entry price is 100.00, then when price breaches the profit trigger price of 101.00 (100 + 20 * 0.05 = 101.00) the stop will be modified to 100.00 (101.00 - 20 * 0.05 = 100.00)

Now the frequency is defined as 10 ticks, thus when price breaches 101.50 (101.00 + 10 * 0.05 = 101.50) the stop will be further modified to 100.50 (101.50 - 20 * 0.05 = 100.50). The stop will be further trailed when price breaches 102.00 (101.50 + 10 * 0.05 = 102.00). At this point the stop price will be 101.00 (102.00 - 20 * 0.05 = 101.00). The process will repeated until the target is reached or the stop is filled.

Example 2

- Profit trigger - 50

- Frequency - 0

- Stop price - 50

Assuming the tick size of the instrument as 0.05, and your average entry price is 100.00, then when price breaches 102.50 (100 + 50 * 0.05 = 102.50) the stop will be modified to 100.50 (102.50 - 50 * 0.05 = 100.00). Now since the frequency value is set to 0 (zero), the stop order will no longer get modified.

A note of caution, please be judicious while setting the parameters of the stop strategy. Most API's has throttling policies and too many modifications (of the stop order) can result in disablement of API access by your broker.

Please read the below points to know more about the functioning of the Multi-level Bracket Orders. Please do note the below list is not exhaustive. There may be scenarios in addition to what listed below

- Unless stated otherwise, please select the ProductType as Margin while submitting an order assigned with the Multi-Level Bracket order template.

- The 'Quantity' as defined for each level represents the absolute quantity.

- In case the order quantity has a defined multiplier/lot size (for example, F&O contracts for National Stock Exchange, India in Interactive Brokers connections) then the quantity must be in multiples of the multiplier/lot size. If not then orders may get rejected by the connection.

- ArthaChitra makes sure that the stop and target orders as submitted will not be in excess of the entry orders filled quantity. For example, if you have 2 (two) bracket levels, with quantity defined as 100 (hundred) and 50 (fifty) and you place an entry order with a quantity of 100, then only the first level will get triggered.

- If the stop or target price is set to 0 (zero) then the same will be ignored. For example if the target is set to 0 (zero) then the target order will be not submitted.

- The stop/target price is calculated from the average fill price of the entry order. If average fill price is not transmitted by the connection, then the limit or stop price will be taken into consideration for Limit/Stop orders.

- The stop and target orders are triggered only when the entry order gets filled. If the entry order is the yet to get filled and you close ArthaChitra, then the stop/target orders will NOT trigger.

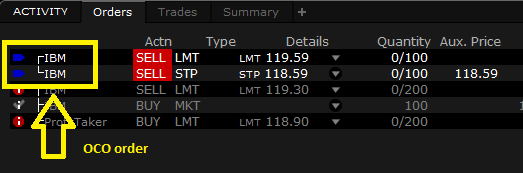

- The stop and target orders for each bracket levels are paired with an unique OCO string. If the connection supports server side OCO simulation then the OCO simulation will be simulated on the server. In case the connection does NOT supports OCO orders then user must run ArthaChitra. If user close ArthaChitra then the OCO simulation will be lost. For more details on OCO tags please click here

- The OCO behavior will be that of the connection. For example, if you are connected with Interactive Brokers, and you cancel the stop order then the corresponding target order will also gets canceled. If the OCO simulation is handled locally by ArthaChitra, then canceling one order wont cancel the other. It will be canceled only when one gets filled.

The OCO link as displayed in TWS (Interactive Broker)

- A maximum number of bracket levels that can be added has been limited to 3 (three). This is keeping in mind the throttling policy which various API implements.

- The stop strategies are simulated locally. Thus if you close ArthaChitra the session will be lost and the stop wont be trailed. This is true even if the connection natively supports OCO simulation.